We Supported by PayPal Payment

PayPal Balance: If a user has funds in their PayPal account, they can use this balance to make payments.

Bank Account: PayPal allows users to link their bank account to their PayPal account. This way, payments can be directly debited from the bank account.

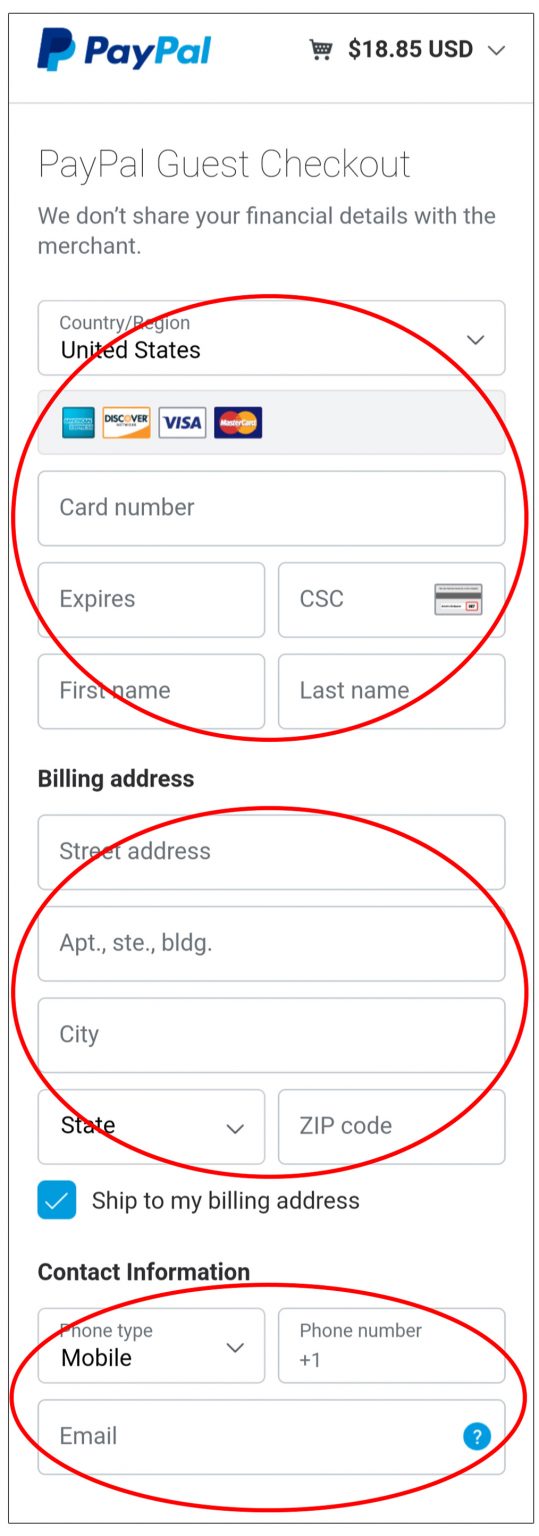

Credit and Debit Cards: Users can link their credit or debit cards (Visa, MasterCard, American Express, and Discover) to their PayPal account. PayPal then charges the card for the payments made.

PayPal Credit: This is a line of credit offered by PayPal that can be used for purchases. It’s subject to credit approval.

E-Checks: This works like a traditional check, but electronically. The amount is withdrawn from the user’s bank account, transferred over the ACH network, and then deposited into the seller’s (your) PayPal account.

PayPal One Touch™: This service allows users to remain logged into PayPal for faster purchases on participating websites. It eliminates the need to log in with a username and password for each purchase.

Mobile Payments: PayPal can be used for mobile payments through their app or other partnered apps and services.

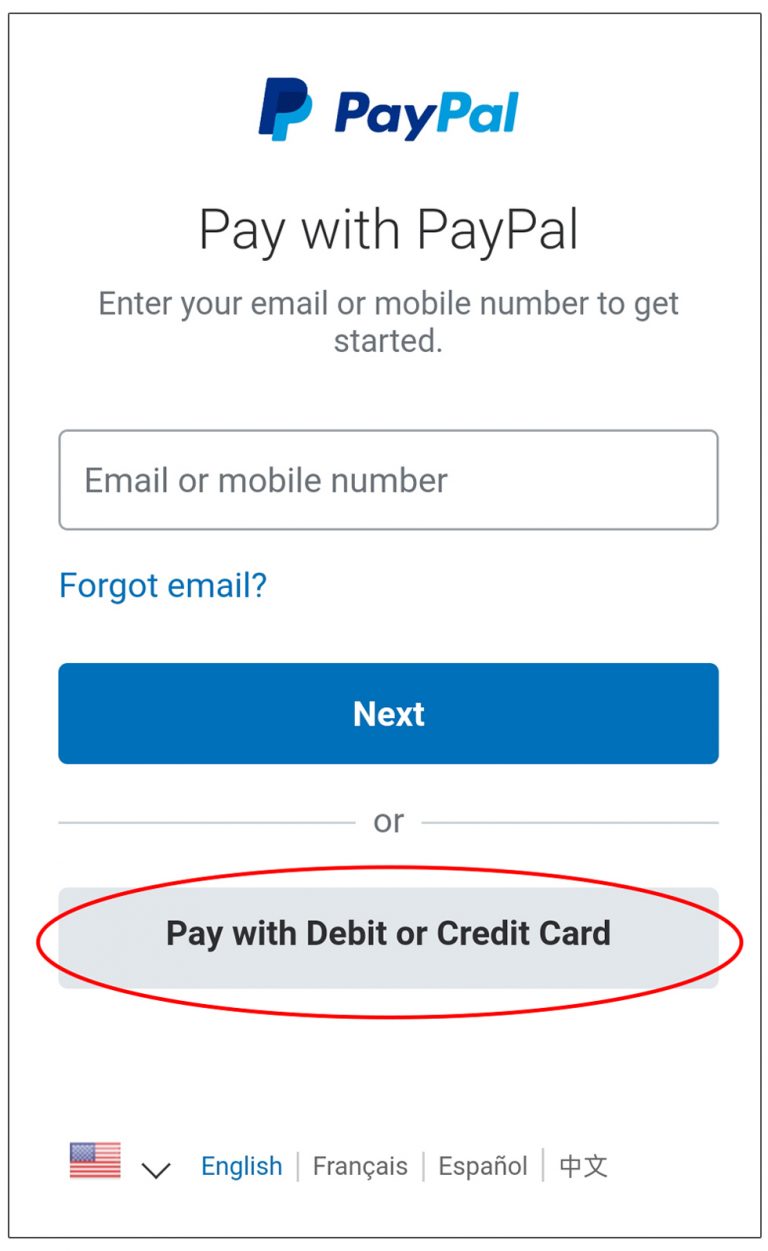

Requirement of a PayPal Account for Payments

PayPal Account Not Always Required: For online purchases, many merchants offer the option to pay with PayPal without creating a PayPal account. This is often done through a guest checkout feature, where customers can use their credit or debit card without signing in to or creating a PayPal account.

Benefits of a PayPal Account: Having a PayPal account can make the transaction process faster and more convenient, as it stores the user's payment information securely. It also provides additional features like transaction history, dispute resolution, and buyer protection.